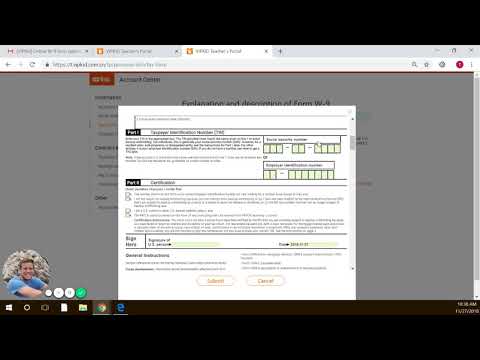

Hi, this is Tom from Grady and Accounting. Have you been receiving the recent emails from VIP Kid about ensuring that you have completed your W-9 in time? I have been seeing some of these emails on my screen, such as the address confirmation and the online W-9 form submission. Sometimes, they can be very confusing and difficult to understand, as they seem to be written in tax language. When you click on one of these emails, it may seem like it is a Chinese company reminding us to pay our taxes. However, if you are considered a US person or a US resident alien, what does this mean for all of us? The reason behind these emails is that since VIP Kid hires us as a third-party company, they are required to submit records to the IRS regarding the amount of money they are paying us. As a result, we also have to report our income to the IRS, ensuring that everyone is paying their fair share of taxes. In order to do this, VIP Kid requires us to submit a W-9 form. So, how do we go about submitting our W-9 form to VIP Kid? The first step is to sign in to our VIP Kid portal. Once on the home screen, navigate to the account center on the left-hand side and click on "tax form." Here, you will be prompted to fill out your W-9 form online. I will guide you through the process and explain common areas where people often trip up, as well as show you how to submit it. If you select the "edit" button, you will be taken to the first field where you need to enter your full legal name, as it appears on your tax return or driver's license. For example, I will fill...

Award-winning PDF software

W-9 2025 PDF Form: What You Should Know

Enter the appropriate social security number: New York State-1 (SSN).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS W-9 2014, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS W-9 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS W-9 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS W-9 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-9 form 2025 PDF