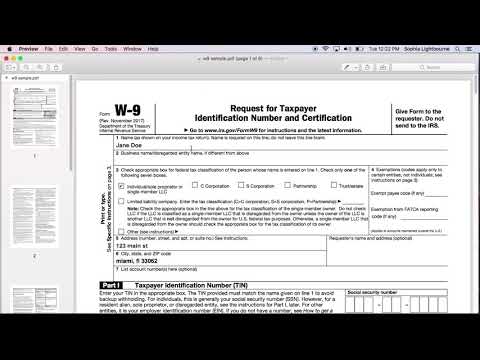

This video is going to show you how to fill out your W9 form correctly so that you can start earning commissions in your business. The first thing you want to do is go into your members lounge and click on the support tab on the left. Scroll down and you will find the W9 form. You can also do a simple search for W9 and download the form. The form may look overwhelming with all the lines and instructions, but don't let it confuse you. It's actually quite simple. In this quick video, I will show you just how simple it is. Start by filling out number one, which is your name as shown on your tax return. For number two, if you don't have a business or LLC, leave it blank. If you are a sole proprietor, select "individual sole proprietor". Skip number four as you don't have any exemptions. Move on to number five and provide your address. If you don't have an account number, skip number seven. The first section is complete, now let's move on to part one. This is where you enter your taxpayer identification number. For individuals, this would be your social security number. Fill it in accordingly. If you don't have an employer identification number, skip that section. Part one is now complete. Moving on to part two, this is simply where you sign and date the form to confirm that you are providing accurate information. After filling in your signature and the date, the form is complete. Now all you need to do is send an email with the completed form to accounting@novemoney.com. That's it! You're done. If you have other affiliates on your team, make sure to watch this video a few times so you can assist them in filling...

Award-winning PDF software

W-9 instructions Form: What You Should Know

Information about Form W-9, Request for Taxpayer Identification Number and Certification, including recent updates and the form for certification (PDF) and an FAQ for the form. Additional instructions for the Form W-9, Request for Taxpayer Identification Number and Certification, include information on whether the form can be filed electronically or at an office of the U.S. IRS. Form W-9 — IRS — Forms and Instructions (PDF) Form W-9, Request for Taxpayer Identification Number and Certification, 1018; Inst W-9, Instructions for the Requestor of Form W-9, Request for Taxpayer Identification Information about Form W-9, Request for Taxpayer Identification Number and Certification, including recent updates, and instructions on making forms available. Instructions for Form W-9 (10/2018) — IRS. A substitute Form W-9 that requires the payee, by signing, to agree to provision unrelated to the required certifications, (PDF) or require an addendum indicating that an individual is exempt from reporting under FATWA, is valid. Payments to individuals, and to certain trusts, that are not required to file Form 940, Non-Farm Payroll Deductions are processed and reported on Form 4641, Electronic Filing of Individual Income Tax Returns. Filed on time, the Form 4641 will be filed electronically. If a taxpayer's Form 4641 is late, a penalty generally would be assessed and the taxpayer will be required to pay interest and fees, to be collected only if the late filing penalty is satisfied. However, there are many other situations under which a penalty or interest could be assessed and collected, such as when the period to file is more than 5 years and the amount of the delay is more than 1,000. Interest and penalties would be assessed against Form 4641 (except for amounts to be paid under the Deferred Deposit Program) as soon as possible after the first day after filing. Interest from the time a penalty was paid on the delayed filing of a Form 4641 will start to accrue on the fifth calendar day after the period to file to which the penalty refers is over. However, penalties must be paid within 5 calendar days of the date of the penalty.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS W-9 2014, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS W-9 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS W-9 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS W-9 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-9 instructions